Plug-n- Play Part- 1: India’s Roadmap to 100% Electric Mobility by 2030

Plug-n-Play Part -2: Which comes first “Electric Vehicle" or "Charging Infra”

Plug-n-Play Part-3: Ever Proliferating xEVs Charging Standards

Plug-n-Play Part - 4: How Fast I need to Charge my xEV & DC Fast Charging Global Battle

]

Rapidly scaling lithium ion battery manufacturing and emerging technologies (improved chemistry) makes it to be of “NO SURPRISE” that the lithium ion battery (LiB) pack price are actually down to less than $200 per kilowatt hour in 2017”, compared with almost $1,000 per kilowatt hour just few years back in 2010.

Recent Bloomberg report “EV Outlook 2017” projected year 2025, as the inflection point for xEVs to go cheaper than ICE. Another, report published by India’s think tank “NITI AAYOG” in association with RMI titled “INDIA LEAPS AHEAD – Transformative Mobility Solutions for All” clearly lays down a road-map for key policy enablers across the value chain of xEV ecosystem, also indicating “battery swapping” as one of the key enabler for jump-starting the EV market in India.

With extensive media coverage on India’s mission of all electric by 2030 and selling vehicles without batteries, battery swapping seems “Silver Bullet “for India’squest to kick-start mass take-off of xEVs while eschewing subsidies. Functionally speaking swapping makes a compelling story but as we’ll try and understand further the realty may or may not fulfil the dream.

The whole premises of “Battery Swapping” lies mainly around few key areas, which vis-à-vis expected to be addresses, thus enabling faster adoption, (listed in priority order)

- High Initial Acquisition Cost of Electric Vehicle: In 2016 batteries constitutes as much as ~48-55% of mass manufactured BEVs, which if separated from vehicle and made available on lease/rent/pay-as-you-go basis, will significantly lower the cost of overall vehicle. It potentially translates that a user need not to own the battery in vehicle, rather transferring that cost over the battery, battery life, maintenance, capital cost , quality, technology and warranty to battery swapping station entity.

- Lower Waiting Time: It potentially enables much lower waiting time for xEVs re-charging, this will surely be of great advantage for fleet operators, low speed xEVs (e.g. e-auto, e-rickshaw etc) since there success lies in being on roads for maximum time.

- Addressing Consumer Sentiments of Range Anxiety: Swapping also possibly addresses the most important “Consumer Sentiment” i.e. the fear of being running out of energy before reaching the final destination, a well-established network of smart swappable battery stations definitely reduces the range anxiety among users.

Contrary, global experiences in battery swapping, poses several questions on this model hitting the bulls eye in India. Globally, battery swapping was not so successful with several players shutting down their shops, and vis-à-vis on the charging infra side also xEV industry is struggling to certain extent, with 4 potential DCFC charging standards competing with each other in the market. (Ref Part – 3 of the series for more details on charging infra)

At the outset, there seems few key potential barriers for battery swapping model. First & foremost domestic availability of lithium ion batteries itself is the biggest barrier for the xEV & well as ESS industry as a whole, followed by couple of other reasons listed hereunder.

- Pre-supposes that the battery price will remain expensive

- Swapping Station Infrastructure is far expensive compared with charging infrastructure options (Level- 2 Charging)

- Poses limitation to seamless migration to new technologies (viz new and more efficient battery chemistries)

- Standardization enabling interoperability across xEV ecosystem.

- Reliability concerns of leased battery packs which likely to be a controversial area

- Cost of Incoming Power Supply (grid power led, renewable energy powered etc)

- Mechanism to optimise “Battery to Vehicle Ratio” to control and optimise Inventory at swap stations

- Seamless & trustworthy payment mechanism for batteries.

Looking at potential barriers listed above, it’s quite imperative to understand practical nuances of Indian automotive ecosystem & clearly identifying the “India Specific Niche” (Buses/Cars fleet or 2Ws/3Ws Segment) to play, for implementing a robust swapping model. . xEVs in itself, is a complete paradigm shift, and is likely to distort a larger energy ecosystem & if as is case basis, swapping stations are also considered, to be just another market problem, “we are surely risking ambitious targets that remains aspirational”. Definitely, markets can & do solve supply chain & other business problems of their own, while ensuring markets to open and achieve economies of scale however government surely needs to play a pivotal role with strong regulatory & policy framework to ensure that India takes leap towards “All Electric by 2030 mission”

Looking at Indian driving behaviour the average travel distance is ~ 40 kilometres/day(Ref: Indian Vehicle Ownership & Travel Behaviour- A case study of Bangalore Kolkata & Delhi: Average vehicle kilometres driven per year by an Indian household was ~5479 miles or ~8817 Kms & average vehicle usage frequency was 226/days/per year)

With this driving behaviour, it’s quite evident that majority of the time, vehicles are at rest either in some or the other place (primarily home or work/office) and given such a scenario of driving range and idle time level-1/2 charging seems enough (3.5 hrs for 80 mile charge & 8 hrs for 200 miles charge) which is fortunately pretty much standardised globally unlike proliferating DCFC standards.

Done Right at First Time. If government & regulatory bodies ensure strong policy framework with clearly identified “India Specific Niche” (“Busses/Cars fleet or 2Ws/3Ws Segment) to play, battery swapping may prove to be of great success in India.

The most likely problem with any large & complex infra project is always execution and so is the case with battery swapping augmented with larger investment & technology associated risks as well. Keeping factors like initial capital cost, battery to vehicle ratio & cost of incoming power supply etc not much of concern at this moment, other factors like rapidly falling battery prices etc, can be addressed with an ecosystem having a reasonably long term cohesive road-map (e.g. invest High on swapping initially to jump-start domestic battery market, followed by investing more on charging infra etc)

Moving further, we are still left with few of the barriers, which are extremely “Critical” for the success of battery swapping & are listed hereunder in priority order

- Indian Specific Niche to Play ( Busses/Cars fleet or 2Ws/3Ws Segment)

- Standardization enabling interoperability

- Reliability of leased Battery Packs

- Seamless and Trustworthy Payment Mechanism

India Specific Niche to Play (Most Critical in Priority Order)

Globally, battery swapping is predominantly implemented for passenger cars, which in turn needs more automated swapping systems, battery weights are much higher and also expensive, results were not so convincing with several large players shutting down their businesses. Identifying a specific niche segment within Indian automotive industry for implementing battery swapping seems likely to change the global perception with India demonstrating both scale and successful implementation of swapping model making “Charge Time” replaced with “Swap Time”

Quick Overview of India Automotive Industry Statistics

India is primarily driven by 2Ws, contributing 80% of the total automobiles sales in 2016 and ~20% of India national mode share, followed by 3Ws which contributed ~3% of total automobile sales in 2016 vis-à-vis buses which is merely 0.18% (~11,450 Units).

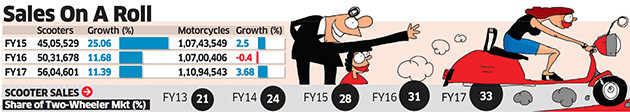

Two wheeler segment grew by ~8% (YoY basis in Q1 of FY 17-18 Vs Q1 of last year), further scooters grew by ~20.06% in the first quarter of FY 2017-18 compared to same period last year, whereas motorcycles grew marginally by ~3.7% year over year (sameperiod). Scooters are all set to surpass the 100-110CC motorcycles, becoming the highest selling two wheeler in India

Given few key points (Viz: industry trend toward scooters, current market share of 2Ws) and also scooters providing somewhat standard space (mostly ~13 litters boot space), 2Ws seems low hanging & promising segment for implementing battery swapping, jumpstarting both domestic battery market and xEV ecosystem in India (few key factors listed hereunder)

- Upfront Capital Cost: 2Ws, especially scooters can be designed enabling quite easy swapping vis-à-vis busses/cars which needs much more complicated & automated infrastructure, substantially increasing upfront capital investment with likely delayed RoI. (2Ws batteries are smaller, lighter & simpler as compared to cars & busses)

- Scalability Economics : 2Ws swapping stations can easily be used for 3Ws (auto-rickshaws & E-rickshaws), further enhancing the multi-usage model, enabling much better business economics for the Industry players to look at.

- Minimised Infra & Permits Requirements: A typical 2W battery swap stations can easily be built at several existing locations (viz: gas stations, petrol pumps, metro stations, public parking, city markets etc) with as quickly as just six seconds for swapping (e.g. Gogoro in Taiwan) and with much lowers cost (e.g. 8000-10K USD each station)

- Usage Flexibility to Users: Swap stations & batteries both can be designed in much smarter way just like an ATM, complimented by DIY operations & batteries can be compatible with both fast charging at swap stations and overnight charging at homes. (Level -1 by amp normal power socket) providing huge flexibility scale.

While on the busses/car fleet segment, given the strong push for e-busses by Govt with certain policy innovations & the idea of absorbing the initial infrastructure cost, provides an opportunity to kick-start the whole xEV ecosystem of the country.However financial viability of the model is inevitable to ensure equal participation by Industry players. Govt bodies need to ensure appropriate policy framework for enabling financial viability else we are surely moving towards“technology politics” giving rise to monopolies in this industry.

Standardisation Enabling Interoperability

Standardised batteries are one of the great consumer goods. Everyone must have bought a pack of AA or AAA batteries for one or more electronic device by now.“Standardisation is Inevitable”. Globally, swapping was implemented mostly by auto OEMs or in some cases strategic tie-ups with auto OEMs (few examples are given hereunder.)

- Better Place together with Renault

- Tesla ( own car & swap stations)

- Gogoro (own scooter & swap network)

Standardization, especially for batteries is inevitable for the evolution of the xEV battery swapping industry and is the only doorway to achieve interoperability across 2Ws/3Ws or at least separately for 2Ws and 3Ws segment across OEMs, so that one station can serve multiple vehicles/auto OEMs making it financially viable business model . Based on industry discussions, given below are few key barriers to achieve the goal:

- Proprietary Technology: Most of the major automakers prefer to procure li-ion cells and like to control their design & engineering strategies for battery packs as their core technology and important IP rights/patents.

- Battery Specifications, Weight & Form Factor: : Unlike AA or AAA batteries, which fits into mostly all electronics devices xEV batteries comes in different chemistries, power densities & form factors and so is the case with auto makers, opting for different type of batteries. Additionally depending upon the chemistries batteries perform & deplete differently making inventory & warranty management a nightmare for swapping entity.

- Removable Packs Design Complications: Making the battery pack removable poses several design obstacles and also increase the overall cost especially from environmental issues (Ingress protections etc).

Government bodies followed by auto OEMs role seems pivotal for enabling this “Inter-operable Standardisation”. Govt together with auto OEMs must need to ensure few factors viz:

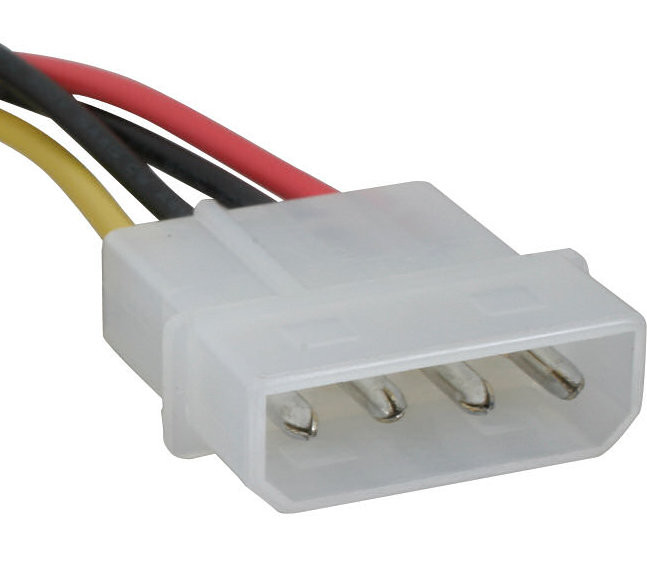

- A standardised power & communication interface between batteries and vehicle system (e.g. some industry standards similar to molex style power connector as shown in picture can be utilised)

- Form factor standards , let’s say a min & max dimensions which fits in most of 2Ws and in case of 3Ws (Auto-rickshaw and e-rickshaw) it should not be a problem given the ample space availability for putting up the batteries.

There has been discussions at several forums around standardisation for both charging & batteries as well. Draft standards for charging got released by ARAI and DHI in Aug 2017 and May 2017 respectively, however standards on the smart swappable batteries has not seen light of the day so far. On the contrary several industry players have already started putting up “Battery Swapping Stations” at few locations primarily targeting 3Ws (auto rickshaws > 100,000 & rickshaws ~ 100,000 with only 29,123 registered so far as on March 2017 in Delhi).

Reliability of leased battery pack and seamless payment mechanism.

It’s of utmost concern that users should get fully charged & reliable battery, whenever they swap and with kind of Indian consumer mindset, some trustworthy factors needs to be carefully embedded, enabling nationwide ecosystem.

Toady people have reasonable trust on gasoline stations reliability (except few cases here-n- there) and the key reason is off-course petrol/diesel/CNG stations are regulated to great extent and also both ICE engines and conventional fuel stations are there since ages and user are well equipped with typical range/litre benchmarks, unlike in case of young and reborn xEV industry.

A typical e-rickshaw or auto-rickshaw driver may take long to really understand the smart swappable batteries related performance nuances (viz: DOD, C- Rate, Cycle-life & Temperature etc) and it takes long to establish range/kwh benchmarks given such wide battery technology spectrum (specially battery chemistries) & even a small distrust instance can led to disaster in swapping model.

Again government role is pivotal to enable a highly transparent & accountable battery reliability & payment mechanism parameters and technology can be one of the key driven for this (e.g. Block chain enabled tracking & payment systems) or it can too simple also, just charge for KWHs delivered by the battery with some sort of upper time limit-cap for utilisation of the pack.

Conclusion Thoughts & Way Forward….

Recent disruption with the launch of Tesla Model 3 Range+ variant going upto 341 miles/550 Kilometres in one charge. Also surprisingly this time Tesla wouldn’t disclose the battery sizing, instead vehicles will be identified by the mile range they are able to deliver per charge cycle.

With this kind of technology improvements on the miles per charge and rapidly falling battery prices, it poses a Big Question, that do we really need battery swapping? With a well-established charging network and phenomenally improving xEVs range/charge across vehicle segments people might not care for swapping rather would like to the own the batteries.

At times “battery swapping” seems to be an uphill task & off-course it can turn out to be a learning curve to implement & really make this work properly. “Done Right First Time”, it may really change the global perception for battery swapping with India being an example for the entire world.